Kisetsu Saison Finance (India) Private Limited, a company registered under the Companies Act 2013 having its registered office at IndiQube Lexington Tower, First Floor, Tavarekere Main Road, Tavarekere, S.G. Palya, Bengaluru, Karnataka 560029, owns, manages and operates this platform, website under the brand name “Credit Saison” (hereinafter referred as “Credit Saison”).

The purpose of this Privacy Policy (“Policy”) is to maintain the privacy of users, members, unregistered visitors, borrowers, customers etc. (hereinafter collectively referred to as “Borrowers” or “Users”) and to protect the personal information of the Users, provided by them to Credit Saison through our website https://creditsaison.in/ ( “Website” or “Platform”) from time-to-time.

Credit Saison through this Policy aims to demonstrate its commitment towards the Information Technology Act, 2000 and Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information), Rules, 2011 (“Rules”) and RBI Guidelines on Digital Lending dated September 02, 2022.

This Policy is applicable to all the information collected, received, possessed, owned, controlled, stored, dealt with or handled by Credit Saison in respect of a Borrower.

1. BORROWERS ACKNOWLEDGEMENT AND CONSENT

i. User acknowledges that by accessing the Platform, Borrowers expressly consent and confirm to collection, maintenance, usage, handling and disclosures of Borrowers information including the sensitive personal data by Credit Saison in accordance with this Policy. The purpose of obtaining Borrowers’ consent shall be disclosed at each stage of interface with the Borrowers. Borrowers acknowledge that they have the option not to provide or agree to the collection of information.

ii. User acknowledges that the Platform may contain links to other websites. If a User clicks on a thirdparty link, the User will be directed to that website. Note that these external sites are not operated by Credit Saison. Therefore, it is strongly advised that Users review the privacy policy of these websites/external links. Credit Saison has no control over and assumes no responsibility for the content, privacy policies, or practices of any third-party sites or services.

iii. Users acknowledge that they have the option not to provide or agree to the collection of information. If a User chooses not to agree with the Policy, they will not be entitled to avail financial services of Credit Saison.

2. COLLECTION OF INFORMATION

When Borrowers use our Platform, we collect and store your information which is provided by you from time to time. Any collection of data by us is need-based and with prior and explicit consent of the Borrowers which can be audited, if required. In any case, Credit Saison shall desist from accessing mobile phone resources such as file and media, contact list, call logs, telephony functions, etc. A one-time access can be taken for camera, microphone, location or any other facility necessary for the purpose of onboarding/ KYC requirements only with the explicit consent of the Borrowers.

The Borrowers shall be provided with an option to give or deny consent for use of specific data, restrict disclosure to third parties, data retention, revoke consent already granted to collect his/her personal data.

Our primary goal in doing so is to provide you a safe, efficient, smooth and customized experience financial services. This allows us to provide services and features that meets your needs, and to customize our Platform to make your experience safer and easier and to improve the services provided by us. More importantly, we collect personal information from you that we consider necessary for achieving the afore mentioned purpose.

In general, you can browse the Website of Credit Saison without telling us who you are or revealing any personal information about yourself. However, to create an account on the Website you must provide us with certain basic information required to provide customized services.

Credit Saison collects various types of information from and about Borrowers of the Platform, including but not limited to the following:

A. Personal Data and Information collected directly

i. Personal Information:

We do not store Personal Information of Borrowers except for some basic minimal data that may be required to carry out our operations. No biometric data should be stored/ collected in the systems associated with the Credit Saison, unless allowed under extant statutory guidelines.

Personal information includes any information concerning the personal or material circumstances of an identified or identifiable Borrowers, e.g. name, e-mail address, gender, date of birth, postal address, phone number, a unique login name, password, password validation, marital status, family details, business information and other details shared via application form or via email or via any other medium. It can also include information such as username, account number, password and any other personally identifiable information.

ii. Financial Information:

We may have access to Borrowers financial information such as bank account, details regarding payment instrument, and transaction data pertaining to Borrowers collected from partnering merchants; and/or bureau data collected from financial organizations (including, inter alia, TransUnion CIBIL Limited and other credit bureaus);

We may also have access to Borrowers payment card details like credit, debit card and/ or internet banking account information etc. collected via the Platform. Borrowers, by submitting these details expressly consents to the sharing of its information with the sellers/merchants, third-party payment processors, payment gateways, payment aggregators and other third-party service providers.

B. Personal Data from Third Parties

i. Credit Reports:

We also collect your credit reports and credit data in the event you have applied for a loan / financial facility to us. In this regard, you:

a. Authorize us, to request and receive your credit score / report from credit information companies.

b. Further fully understand that the purpose of this credit score / report is to enable us to make informed lending decisions effectively and enable faster processing of credit applications to help provide speedier access to credit through our Platform.

C. Collection of Other Non-Personal Information

i. Additional Information

We automatically track certain information about you based upon your behavior on our Platform. We use this information to do research on our Borrowers’ demographics, interests, and behavior to better understand, protect and serve our Borrowers and improve our services. This information is compiled and analyzed on an aggregated basis .

We also collect your Internet Protocol (IP) address and the URL used by you to connect your computer to the internet, etc. This information may include the URL that you just came from (whether this URL is on our Website or not), which URL you next go to (whether this URL is on our Website or not), your computer browser information, and your IP address.

ii. Cookies

Credit Saison may use “cookies” as required on the Website. “Cookies” is a term generally used for small text files a web site uses to recognize repeat users, facilitate the user’s ongoing access to and use of the site, allow a site to track usage behaviour and compile aggregate data that will allow content improvements and targeted advertising, preferences etc.

Cookies themselves do not personally identify the User, but it identifies User device. Generally, cookies work by assigning a unique number to the computer that has no meaning outside the assigning site.

For the purpose of this Policy, Users are informed that cookies also exist within mobile applications when a browser is needed to view certain content or display an ad within the application.

Users are being made aware that Credit Saison cannot control the use of cookies or the resulting information by advertisers or third parties hosting data on Credit Saison’s Platform. If Users do not want information collected through the use of cookies, they may change the settings in the browsers that allows to deny or accept the cookie feature as per User discretion and in the manner agreed by them.

iii. Web Beacons

The web pages of the website contain electronic images known as “web beacons”, sometimes called single-pixel gifs and are used along with cookies to compile aggregated statistics to analyse how the Page 6 of 11 website is used. Web beacons may also be used in some of Credit Saison’s emails to so as to know which emails and links recipients have opened, allowing it to gauge the effectiveness of its customer communications and marketing campaigns.

3. MODE OF COLLECTION OF INFORMATION

Credit Saison may collect User information in a manner that includes the following:

i. Information that the User provide to Credit Saison by filling in registration / enrollment / signing up forms on the Platform and for KYC purposes.

ii. Information that the User provides when Users writes directly to Credit Saison by way of e-mail, letters, messages, etc.

iii. Information that the User provide to Credit Saison over telephone. Credit Saison may make and keep a record of the information shared by the Users with Credit Saison.

iv. Information that the Users provide by completing surveys, a survey, poll, sweepstakes, contest or promotion scheme;

v. Information that the User provides merely by accessing/navigating the Platform.

vi. Information collected by Credit Saison through independent third-party sources like merchants, financial organizations (including, inter-alia, TransUnion CIBIL Limited and other credit bureaus.

4. USE OF BORROWERS INFORMATION

By submitting Borrowers information to Credit Saison, Borrowers expressly acknowledge and consent to use of such information in a manner specified under this Policy.

Borrowers information can be used for various purposes including without limitation the following:

i. Verifying Borrowers identity;

ii. Facilitate Borrowers with usage of Platform;

iii. To obtain credit reports and evaluate your creditworthiness for availing the loan / facility from Credit Saison;

iv. For extension of loan and financial services to the Borrowers by Credit Saison;

v. To ensure compliance with all legal obligations of Credit Saison, vis-à-vis Know-your Customer, Prevention of Money Laundering, CKYRC requirements, etc;

vi. For fraud prevention and detection;

vii. To send Borrowers surveys and marketing communications that Credit Saison believes may be of Borrowers interest;

viii. To analyse, conduct internal reviews, surveys and understand the Borrowers, improve the content and features of the Platform;

ix. To diagnose technical problems, provide support and help Borrowers in addressing troubleshoot problems;

x. To send and received communications, show advertisements, notifications and make promotional offers;

xi. To prepare reports, review and filing as per applicable laws;

xii. To contact Borrowers regarding third party services and offers;

xiii. To understand Borrowers preferences, requirements;

xiv. To permit Borrowers to participate in interactive features offered through the Platform;

xv. To improve the content and protecting the integrity of the Platform;

xvi. To increase / improve the products / services offered by the Lender on the Platform;

xvii. To ensure compliance with all applicable laws.

5. DISCLOSURE OF INFORMATION

We will share your information with third parties to facilitate provisioning of services by us to you only in such manner as described below:

i. We may disclose your information to our third-party service providers for providing the Services as detailed under the Terms & Conditions;

ii. We may share your information with our third-party partners in order to conduct data analysis in order to serve you better and provide services on our Platform;

iii. We may disclose your information, without prior notice, if required under any law or if we are under a duty to do so in order to comply with any legal obligation or an order from the government and/or a statutory authority, or in order to enforce or apply our terms of use or assign such information in the course of corporate divestitures, mergers, or to protect the rights, property, or safety of us, our Borrowers, or others. This includes exchanging information with other companies and organizations for the purposes of fraud protection and credit risk reduction.

iv. We may also share the data / information with our technology service providers and outsourcing partners to perform credit and know your customer checks to facilitate a loan for the Borrowers as per applicable laws;

v. We may share your data with our affiliates and/or group companies for data processing and analysis;

vi. We and our affiliates may share your information with another business entity should we (or our assets) merge with, or be acquired by that business entity, or re-organization, amalgamation, restructuring of business for continuity of business.

Except as required under applicable laws or pursuant to a court / government order, any information or data shared by us with third parties shall be disclosed pursuant to a confidentiality agreement which inter alia restricts such third parties from using the said data only for the purpose of provisioning the services to us to enable us to provide Services to you and also restrict further disclosure of the information unless such disclosure is for the purpose as detailed under that confidentiality agreement.

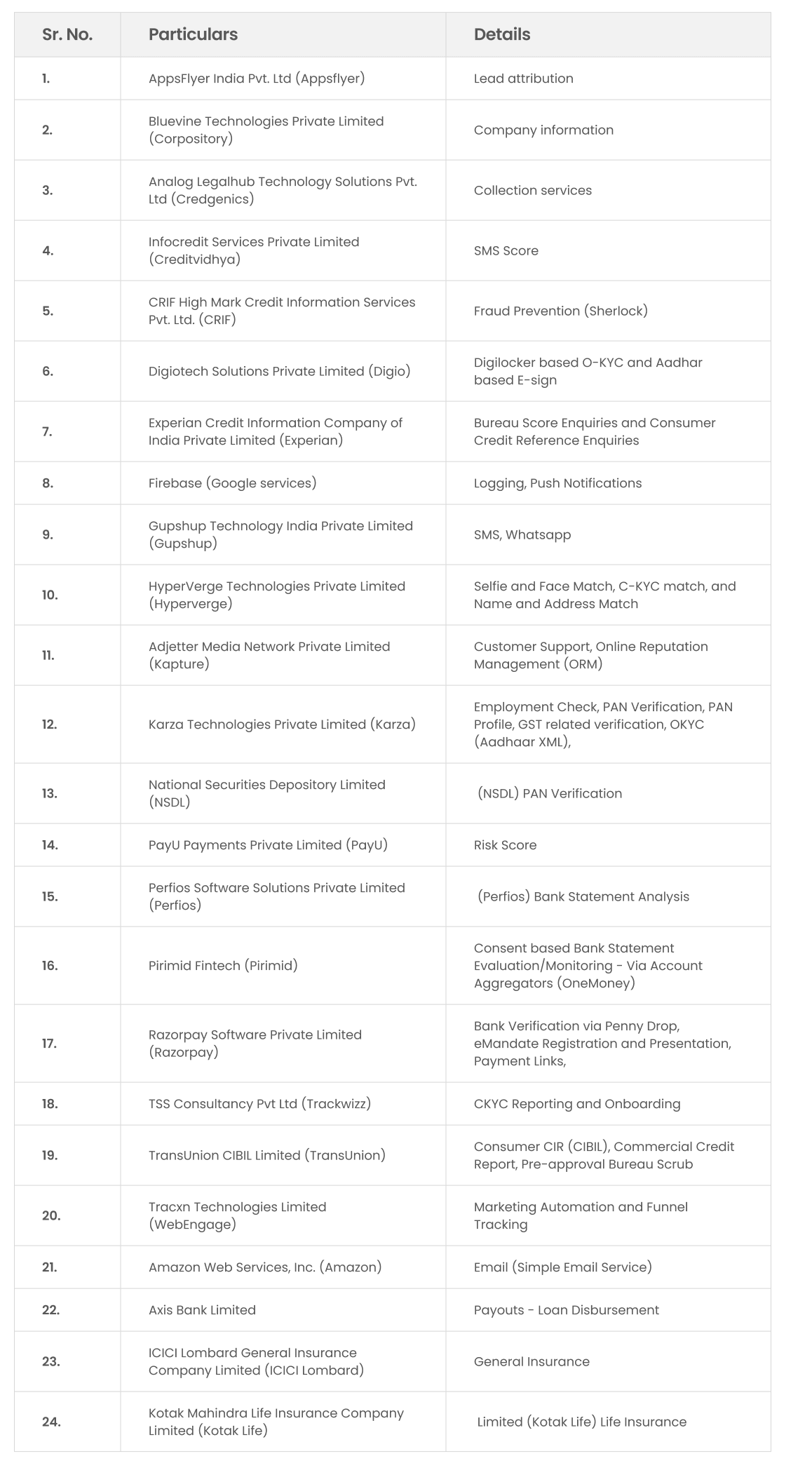

6.THIRD PARTIES WITH WHOM INFORMATION IS SHARED

Following are the list of third parties with whom your information may be shared in connection with the loan applied/sanctioned.

7. DATA PROTECTION, RETENTION AND STORAGE

Pursuant to Information and Technology Act, 2000 and Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011 and RBI Guidelines on Digital Lending – dated September 02, 2022, Credit Saison endeavors to protect sensitive personal and personal information and data of the Borrowers.

You further understand and agree that repayment of a loan / financial facility does not automatically rescind the consents you have provided to us under the Privacy Policy nor does deletion of your account with the Platform.

We shall store your information and/or data for such period as may be required by Credit Saison to (i) enforce its legal rights and obligations against you; (ii) to ensure compliance with its obligations and responsibilities under applicable laws in the capacity of a lender regulated by the Reserve Bank of India.

We store and process your personal information on cloud servers. Some of the safeguards we use are firewalls and bit data encryption using SSL, and information access authorization controls. We use reasonable safeguards to preserve the integrity and security of your information against loss, theft, unauthorized access, disclosure, reproduction, use or amendment. To achieve the same, we use reasonable security practices and procedures as mandated under applicable laws for the protection of your information. Information you provide to us may be stored on our secure servers located within India.

We shall take all appropriate action to comply with data security and protection obligations including without limitation, the adoption of appropriate technical and organisational methods to ensure that computer and information systems are safeguarded against accidental destruction, loss, technical malfunction, falsification, theft, unlawful use, unauthorised modification, copying or improper access or any other unauthorised activity. We shall also ensure that the Personal Data (Personal Data means the ‘personal information’ and ‘sensitive personal data or information’ as defined under the Information Technology Act, 2000 and the Information Technology (Reasonable security practices and procedures and sensitive personal data or information) Rules, 2011, as amended from time to time) of the Borrowers of are protected.

You agree and acknowledge that your personal data will continue to be stored and retained by us as required or permitted by applicable laws or regulatory requirements, or as required for defending future legal claims. All the other details will be deleted or render the data into anonymised data upon the request of the customer for the deletion of the data, provided there is no active loan or service being availed by you. However, in some instances, we will be unable to facilitate requests for the deletion of your data in Page 10 of 11 compliance with legal obligations, or in accordance with applicable laws, which may require us to store data for longer periods of time.

Upon completion of the retention period for each category of personal data as described above, we shall delete or destroy, to the extent technically possible, personal data in our possession or control, or render the personal data into anonymised data, so that it no longer constitutes personal data .

8. UPDATE BORROWERS INFORMATION

Borrowers are required to update their information available with Credit Saison as and when there are any changes. Borrowers are also entitled to review the information provided and ensure that any personal information or sensitive personal data or information found to be inaccurate or deficient be corrected or amended as feasible.

9. INTELLECTUAL PROPERTY RIGHTS

All content on the Platform, including graphics, text, icons, interfaces, audio clips, logos, images, reviews, comments and software is the property of Credit Saison and/or its content suppliers and is protected by Indian and international copyright laws and other applicable intellectual property laws. Any use, including the reproduction, modification, distribution, transmission, republication, display or performance, of the content on this Platform can only be made with the express written permission of Credit Saison. All other trademarks, brands and copyrights other than those belonging to Credit Saison, belong to their respective owners and are their property. Users shall not modify the paper or digital copies of any materials that are printed off or downloaded in any way on or from the Platform, and Users must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text. USERS MUST NOT USE ANY PART OF THE CONTENT ON THE PLATFORM FOR COMMERCIAL PURPOSES WITHOUT OBTAINING A WRITTEN LICENCE TO DO SO FROM CREDIT SAISON OR ITS LICENSORS. IF THE USER PRINTS OFF, COPY OR DOWNLOAD ANY PART OF THE PLATFORM IN BREACH OF THE TERMS HEREOF, THEIIR RIGHT TO USE THE PLATFORM WILL CEASE IMMEDIATELY AND USER SHALL, AT ITS OPTION, RETURN OR DESTROY ANY COPIES OF THE MATERIALS MADE, THEREOF.

10. CHANGES TO PRIVACY POLICY

In the event Credit Saison modifies this Privacy Policy, the same will be updated on the Platform. In case of any material changes to the Policy, the Users will be notified by means of a notice on Platform prior to the change becoming effective. The Users are encouraged to periodically review this page for the latest information on Credit Saison’s privacy practices.

11. FOREIGN JURISDICTION

Credit Saison makes no representation that the content contained on the Platform is appropriate or to be used or accessed outside of India. If the Users use or access the Platform from outside India, they do so at their own risk and are responsible for compliance with the laws of such jurisdiction.

12. SEVERABILITY

Credit Saison has made every effort to ensure that this Policy adheres with the applicable laws. The invalidity or unenforceability of any part of this Policy shall not prejudice or affect the validity or enforceability of the remainder of this Policy.

13. NO WAIVER

The rights and remedies available under this Policy may be exercised as often as necessary and are cumulative and not exclusive of rights or remedies provided by law. It may be waived only in writing. Delay in exercising or non-exercise of any such right or remedy does not constitute a waiver of that right or remedy, or any other right or remedy .

14. GOVERNING LAW OR DISPUTE RESOLUTION

This Policy shall be governed by and construed in accordance with the laws of India with courts in Bangalore having the exclusive jurisdiction from any matter / dispute arising from this Policy.

15. DISCLAIMER

Neither Credit Saison nor any of its contractors, partners or employees shall be liable for any direct, incidental, consequential, indirect or punitive damages arising out of access to or use of any content of this Platform.

FURTHER, CREDIT SAISON IS NOT LIABLE FOR ANY KIND OF DAMAGES, LOSSES OR ACTION ARISING DIRECTLY OR INDIRECTLY DUE TO YOUR USE OF PLATFORM OR ANY PART THEREOF.

16. GRIEVANCE REDRESSAL OFFICER

In accordance with the relevant provisions of the Information Technology Act, 2000 and Rules made thereunder, Credit Saison has designated the Grievance Officer. Users can contact the Grievance Redressal Officer with respect to any complaints or concerns regarding the handling, storage, disclosure of User Information.

All issued can be addressed at the following:

Grievance Officer Name: Emaad Khan

Email address: support@creditsaison-in.com

Customer Service Helpline – 1800 212 2070

The Grievance Officer can be contacted between 10:30 a.m. to 6:00 p.m. from Monday to Friday except on public holidays.